ACQUISITION DETAILS

We are pleased to announce the successful acquisition of Riga powerhouse. The purchase agreement was finalized on November 22nd, making Ventus Energy Group OU the new owner and operator of the powerhouse.

“This marks a significant milestone in the growth of Ventus Energy. While we have been actively operating for only a few months, we’ve already attracted considerable attention from lenders. Most importantly, we are delivering on our promises with tangible results. Riga powerhouse is already operational and generating stable profit, becoming one of the cornerstones for our success. Following this achievement, we plan to launch the Daugavpils powerhouse Q1 2025, along with other future energy projects development,” reflects Henrijs Jansons, CEO of Ventus Energy Group.

ABOUT THE POWERHOUSE

Riga powerhouse is a combined heat and power (CHP) plant located in Riga, the capital of Latvia. It is connected to the city’s district heating system (managed by Riga Municipality) and the electricity and natural gas grids.

Commissioned: 2009

Energy Output: Total 40.9 MWh

- Electrical: 14.9 MWh

- Thermal: 26 MWh

The powerhouse is staffed by a skilled operations team and equipped with all necessary engines, ensuring efficient and reliable energy production for the city.

REVENUE STREAMS AND FUTURE GROWTH

Riga powerhouse generates stable revenue from three key sources:

- Electricity: The plant produces around 18,500 MWh of electricity annually, with an operational run time of approximately 1,200 hours annually. This electricity is sold in the Nord Pool market, generating around 3 million EUR in annual revenue.

- State Subsidies: The powerhouse benefits from guaranteed capacity payments from the Latvian government. These payments are valid until 2027 and contribute approximately 2.28 million EUR annually.

- Heat: The plant also produces and supplies 72,000 MWh of heat annually to Riga’s district heating system. This revenue stream generates an additional 3.8 million EUR per year.

Looking ahead, Ventus Energy expects to add a new revenue stream in 2025 when the plant will begin participating in the electricity balancing market. This will involve engaging in grid balancing during peak price periods.

FINANCIAL & OPERATIONAL HIGHLIGHTS

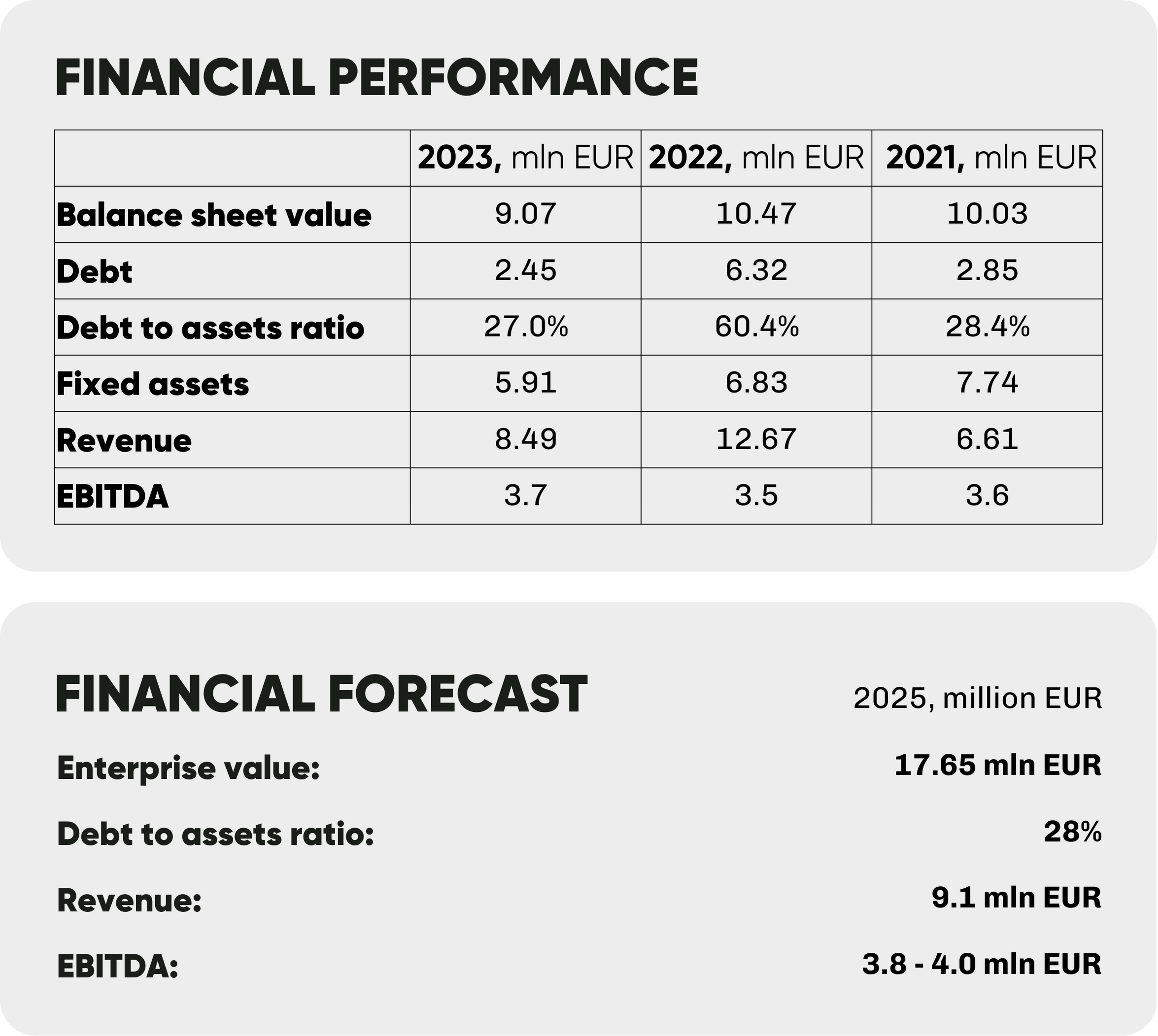

Average EBITDA (last 3 years): 3.6 million EUR/year.

Current Valuation: Estimated at 17.65 million EUR (by SIA Interbaltija).

Market Position: Riga powerhouse is the 3rd largest private cogeneration plant in Riga.

Revenue Breakdown (Planned, 2025):

- Electricity: ~30%

- Heat: ~40%

- Subsidies: ~20%

- Grid Balancing: ~10%

FINANCING THE POWERHOUSE ACQUISITION

To acquire Riga powerhouse, 10 million was raised as debt:

Mezzanine Financing (30%):

- Amount: 3 million EUR.

- Annual Interest Rate: 18%.

Senior Financing (70%):

- Amount: 7 million EUR.

- Annual Interest Rate: 6%.

Weighted Average Financing Cost for the project is 9.6% per annum.

“We are deeply grateful to our partners and lenders who trust in our vision, expertise, and energy. In less than three months, we achieved what seemed nearly impossible - fully financing the acquisition and successfully closing the transaction. On behalf of the entire Ventus Energy team, I would like to express our sincere gratitude to the 1,200 lenders from Germany, Spain, France, and beyond,” added Henrijs Jansons.

We would like to invite our lenders and partners interested in visiting Ventus Energy and touring Riga powerhouse and our other objects. Please feel free to contact us at info@ventus.energy or toms.abele@ventus.energy to arrange a visit or for other inquiries.

We look forward to offering new financing opportunities in our energy industry's future projects.