In the first seven months, more than 1 900 active lenders have already appreciated the potential of Ventus Energy’s project financing opportunities. These projects attract investors not only due to the stable energy industry, effective interest rates (with the compounding interest feature), and the company’s rapid growth, but also thanks to lender-friendly innovations like the Early Exit functionality.

Starting April 1st, 2025, selected Ventus Energy projects will include the Early Exit feature. What is it, how does it work, and what are the benefits? Let’s take a closer look.

What is Early Exit?

Early Exit is a feature that allows a lender to request an early repayment of their loan – either partially or in whole. It’s designed to increase capital liquidity for lenders.

Given the nature of energy infrastructure development and construction, most Ventus Energy projects are long-term (2–5 years). Early Exit gives lenders flexibility and the opportunity to reclaim their loan sooner.

How does Early Exit work?

- The Early Exit feature becomes active typically 6 months after a project is launched.

- A lender can request full or partial loan repayment using the Early Exit function.

- Repayment of the principal happens only when other lenders fund the same project for the requested amount.

- From the moment the lender activates Early Exit until it is fulfilled, the lender continues to earn interest on the requested amount.

- If a lender with activated compound interest functionality wishes to exit the full amount from a particular project, it must turn off the compound functionality. Otherwise, the principal amount in this project will continue to grow while the amount requested for the Early Exit is pending.

- If a lender has a pending Early Exit request, this lender cannot make a new loan in this project.

- If multiple lenders request Early Exit from the same project, the requests are processed chronologically – the earliest request is fulfilled first.

Example / Martin’s experience with Early Exit

To better illustrate how Early Exit works, here’s a simple example:

On October 1st, 2024, Martin funded the Powerhouse Jugla project with € 4000 at an 18% p.a. He also received a cashback bonus and enabled the compound interest feature.

The Early Exit function becomes available for this project on April 1st, 2025.

On April 2nd, Martin decides to withdraw €2,000 due to unexpected expenses. He activates the Early Exit feature and specifies the amount. Please see the steps below:

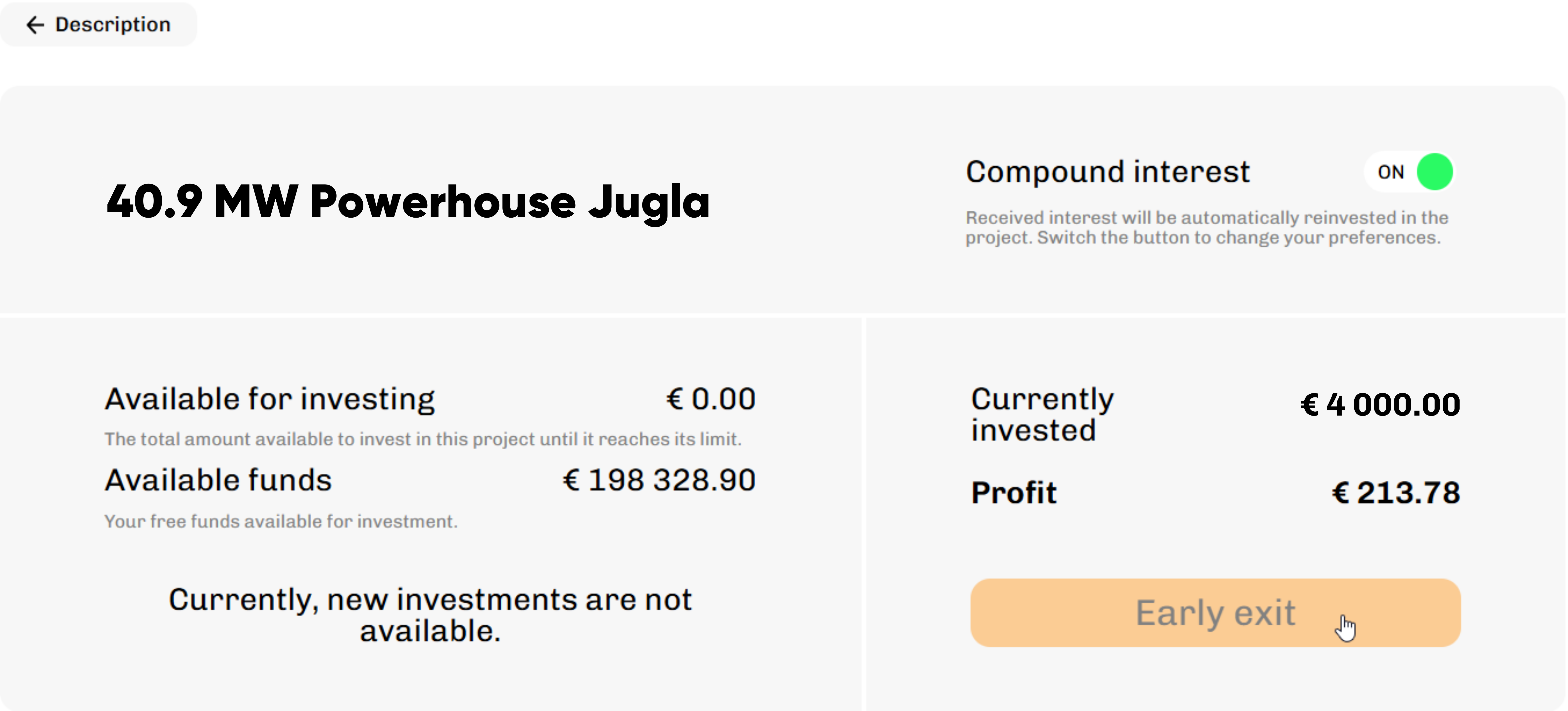

Step 1: Go to the particular project’s investment card and press the Early Exit button:

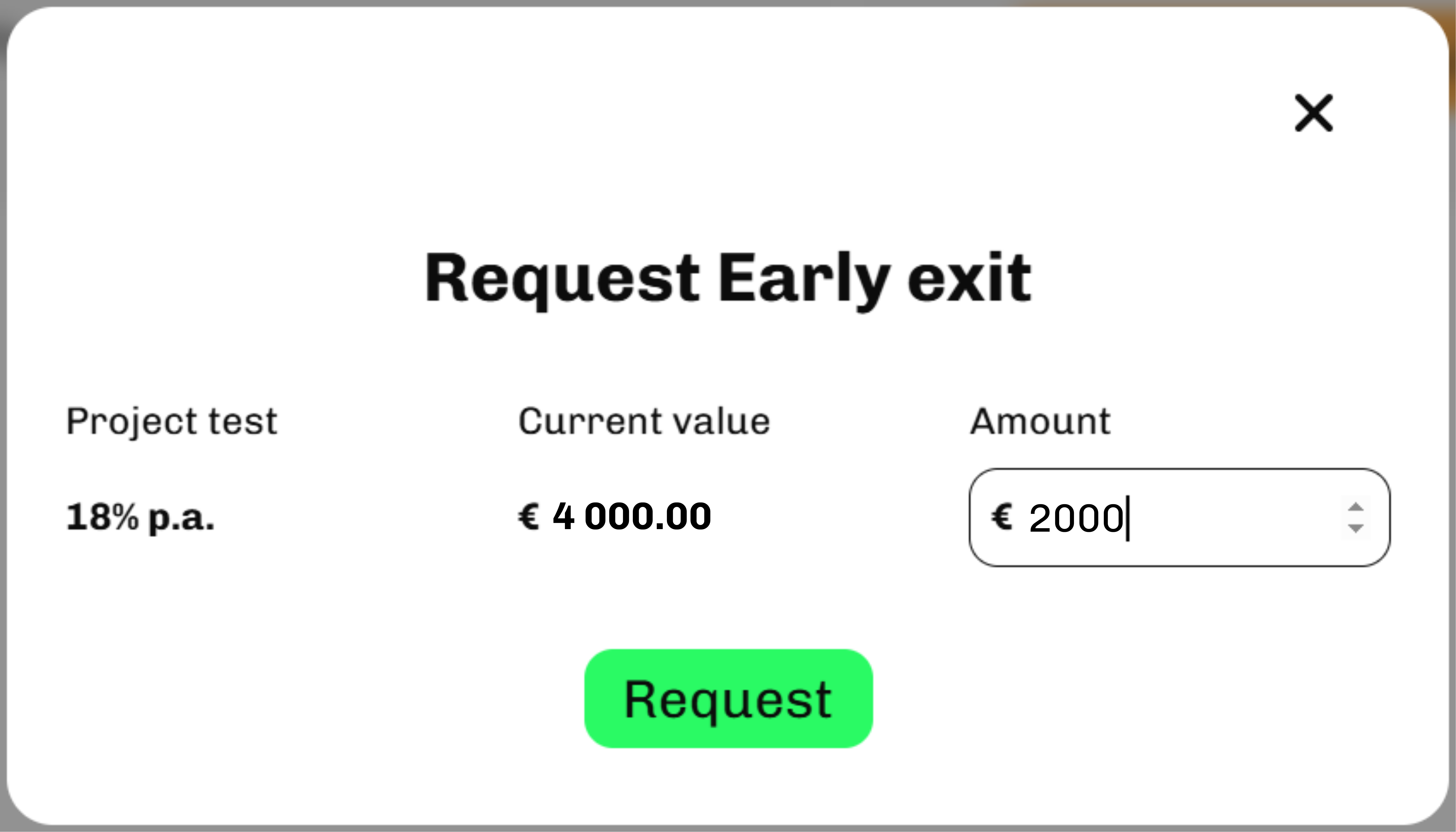

Step 2: Enter the amount you wish to withdraw from the project and press the Request button:

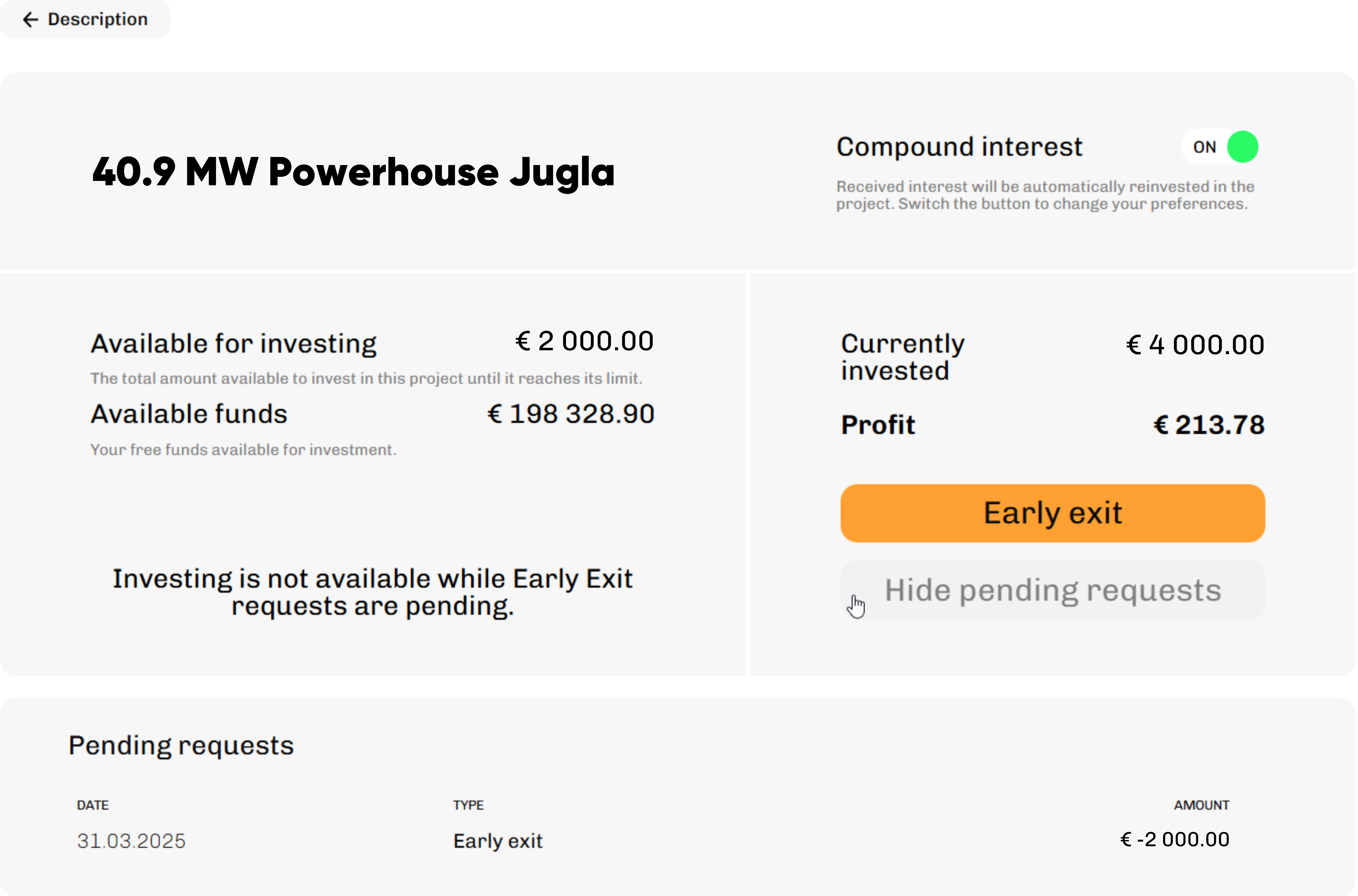

Step 3: See your pending Early Exit requests:

The Powerhouse Jugla project becomes available again in the INVEST section to other lenders the same day. It now shows an open funding volume of €2,000 at the same 18% p.a. interest rate (funding volume will be the total amount of all lenders' active Early Exit requests in this project ).

Martin continues to earn 18% p.a. interest on the €2,000 while his request is pending.

On April 3rd, another lender, Stephan, funds €1,000 into the Powerhouse Jugla project.

On April 4th, Martin continues to earn interest on the full requested amount.

On April 5th, the lender, Alex, funds the remaining €1,000, and Martin receives €2,000 in his Ventus Energy account the same day. His Early Exit is now fully completed.

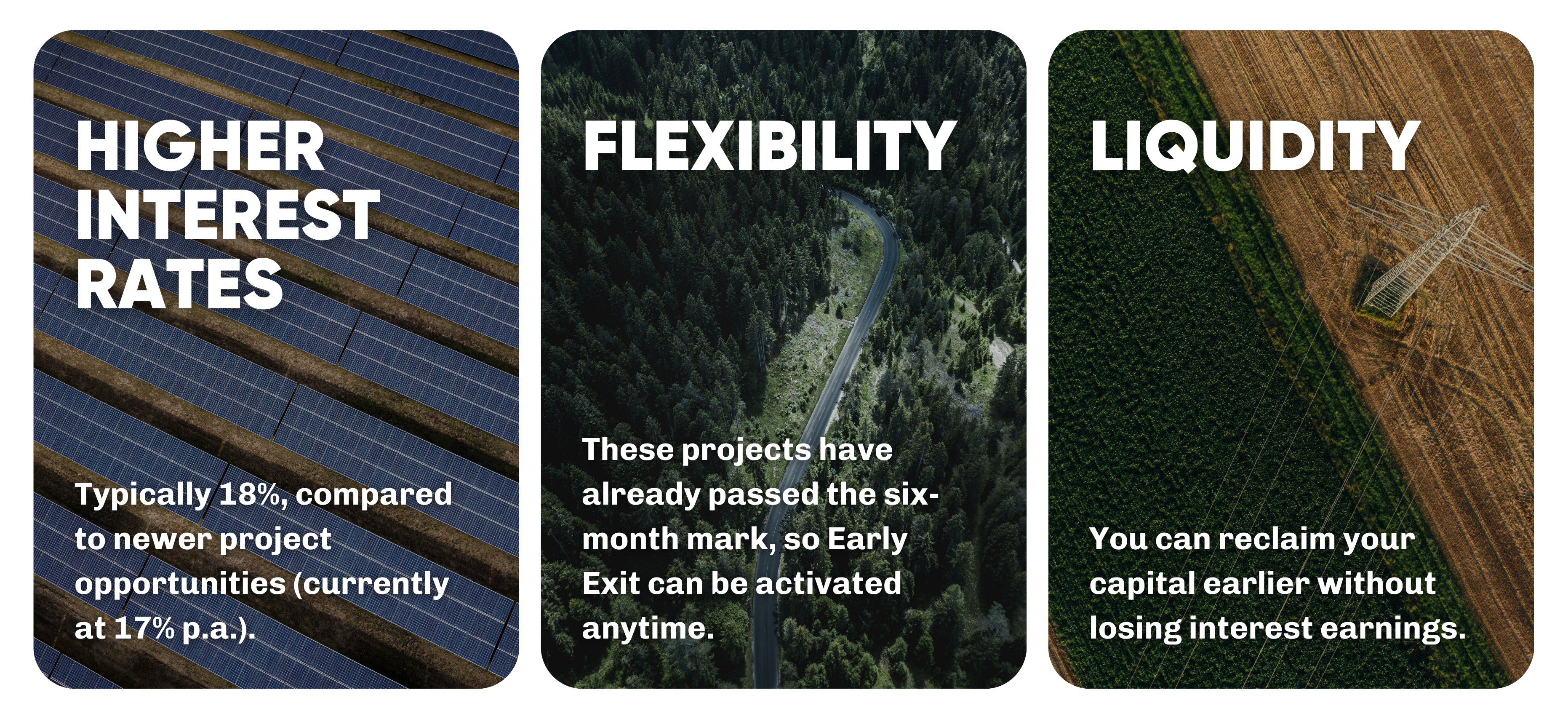

Why fund projects with active Early Exit?

Projects that are with so-called “Active Early Exit” offer several advantages:

Thank you for supporting Ventus Energy Group’s development projects. Let’s succeed together.